John Needham, Australian attorney and stock trader has recently received a great deal of attention for his market trading theories, which he calls the Danielcode. Largely based on the life work of W.D. Gann (image-right), a legendary market trader known for his uncannily accurate and highly successful market trading, the Danielcode, as the title implies, is further inspired by Needham's reading of a passage from the Book of Daniel, specifically Chapter 12 ,verse 12: "Blessed is the man who has patience and perseveres until the one thousand three hundred and thirty five days". In Needham's own words:

John Needham, Australian attorney and stock trader has recently received a great deal of attention for his market trading theories, which he calls the Danielcode. Largely based on the life work of W.D. Gann (image-right), a legendary market trader known for his uncannily accurate and highly successful market trading, the Danielcode, as the title implies, is further inspired by Needham's reading of a passage from the Book of Daniel, specifically Chapter 12 ,verse 12: "Blessed is the man who has patience and perseveres until the one thousand three hundred and thirty five days". In Needham's own words:

The Danielcode is an ancient and mystic sequence of numbers stretching from zero to infinity. It predates the Fibonacci sequence by 18 centuries. The Danielcode was originally written as a timing mechanism for the Jewish people. These are Daniel’s words from the Bible:

Dan 12:12 Blessed is he that waiteth, and cometh to the thousand three hundred and five and thirty days.

In sacred geometry, numbers and sequences have multiple meanings. The number 7 can mean 7 days, weeks, years etc. It can also mean 70 or 700 so the decimal point can slide. The square root of 1335 is 36.537. If we slide the decimal point we get 365.37 which is an astonishingly accurate measurement of a calendar year.

Needham has established quite an impressive track record as well, correctly predicting the bear market rally in the equities beginning in March 2009 as well as a string of other impressive prognostications which he has duly recorded on his web site Danielcode Online. Add him to the list of Prophets for Profit. Needham is the latest in a line of traders and market savants who employ relatively abstruse methods such as Elliot Wave Theory which has acquired such caché that it has become a regular part of the curriculum in mainstream economic institutions.

Formulated by accountant R.N. Elliot in the 1930's and popularized by Robert Prechter, the Wave has become an established and essential tool for economic analysis and especially stock trading Prechter has been the most visible proponent of Elliot Wave theory over the past several decades, editing and publishing Elliot's books and producing several of his own volumes on the subject. He gained some notoriety for predictions involving recent market highs andows, notably the top in October 2007 and the subsequent bottom in February 2009. However his prognostications have received much criticism. He has consistently called for crashes ever since the famous collapse in 1987 with little success. His most enduring lapses have likewise been in reference to the gold market whose top he has been unsuccessfully predicting for the better part of the last decade. On the other hand the more obscure and certainly more prescient Alf Field has consistently predicted the resurgent gold bull market ever since lift off in 2001 using Elliot Wave.

Needham's guru, W.D. Gann, relied primarily upon a complex interaction of angles as the basis of his market augury predicated on the 90 degree right angle with the vertical axis denoting price and the horizontal indicating time. No surprise there I suppose, but it was not Gann's elaborate and unique interpretation of such simple functionality alone that led to his amazing prescience which guaranteed him a large following willing to pay exorbitant sums for privileged access to his arcane science. Less known was his close association with the astrologer Sepharial, the nom de plume of one Walter Gorn Old, to whom he owed much of his prophetic prowess in profit. On the surface this was a distinctly improbable relationship given Gann's strict and apparently devout fundamentalist Baptist confession. And yet, as it is with so many historical notables, Gann's religious profession was but the persona masking his deep and abiding involvement with freemasonry. Sepharial himself was deeply connected with the notorious theosophist thaumaturge and Ohkrana agent Helena P. Blavatsky with whom he resided. Among Sepharial/Gorn Old's most notable accomplishments was the improbable feat of winning the Cuba lottery five times (!) a testimony to his much admired proclivity in the practical application of his extraordinary mantic gifts.

Back to Needham. The Aussie lawyer's trading career, by his own admission, plied a circuitous and tortuous path between investment seminars, tutorials, and other multifarious programs designed to unlock the secrets to consistent and effective stock market trading, all at great expense, and was augmented by a large and likewise costly and steadily growing library comprised of the vast literature devoted to investment and marketing analysis. All to little avail. It was only when he discovered Gann, and in the process retrieved him for posterity from the obscurity into which he had unexplainably fallen, that the scales fell from his eyes and he discovered a reliable and workable system that actually produced scientifically verifiable results. And yet there was something missing. Gann's system of angles was correlated with the influence of vibrational frequencies which Sepharial had discovered in relation to planetary aspects effective at the time of the introduction of the various specific stock offerings to the market- thus their "birth", an all important index in astrological analysis. Needham eventually dismissed these and other astrological indices as too cumbersome and dependent on and thus at the whim of vague and sometimes unreliable insights of the individual practitioner preferring instead to anchor his system on the bedrock of sound empirical principles. As a result he came to rely on algorithmic formulas based on the numerological indications in the Book of Daniel and found a surprising and somewhat unexpected consistency with Sepharial's own vibrational frequencies, which confirmed his belief in the inherent order governing all phenomena including, and most importantly to him, the indices on the stock markets and currency exchanges. Thus with a stripped down, modernized and demystified and above all marketable program, Needham was off to the races, which is of course an international lecture and seminar circuit, peddling the latest infallible once in a lifetime ticket to the promised land of endless profits.

This trail had been blazed decades before Needham's rediscovery of W.D. Gann due to the efforts of the legendary Martin A. Armstrong. (image- above) The boy genius Armstrong's career began auspiciously. By the age of fifteen, he had parlayed a pubescent interest in coin and rare stamp collection into a million dollar fortune, opening his own dealership at twenty-one. His basic interest in ancient and modern history and antiquities pervades his prolific economic essays. Much like Gann, who managed only a third grade education before being compelled to childhood bondage at the family farm on the hardscrabble plains near Lufkin, Texas, Armstrong was largely autodidact, characterizing himself as acquiring his education in the pits of the exchanges where he could "smell the blood" of the visceral and heady atmosphere of the day trade. Armstrong's interests extended into computer science as well. As the founder of Princeton Economics International LTD., he is largely responsible for a groundbreaking program which developed Kondratieff long wave cycle theory combined with Armstrong's pi-cycle into a comprehensive analytical tool for prediction of world economic cycles. With this system Armstrong notably called the top in the Japanese Nikkei months before its crest in 1989 as well as the high in US equities reached on July 20,1998, again several months before the fact. But it was his models for international economic markets, the profound implications of which garnered the interest of several foreign governments including China that also attracted the attention of the CIA. The nature and extent of the program was such that the government, convinced that this program had extremely deep implications for "national security", offered Armstrong a vast sum for its proprietary contents which Armstrong refused. The ensuing events led, according to Armstrong and his supporters, to a frame-up on charges of financial fraud involving Japanese investors and a supposed Ponzi scheme involving the Republic Bank of New York and to Armstrong's imprisonment in 1999, on contempt charges for failing to hand over all the proceeds (several gold bars and Roman antiquities) of his alleged fraudulent activities. Armstrong did hand over some millions worth of bullion and Republic Bank paid some $660 million in reparations. Apparently a government raid on Armstrong's business and residence including the seizing of his computer files failed to yield the desired program which Armstrong had rigged to self destruct if the requisite computer were to be moved. Is is suggested that the failure to surrender his proprietary claim on his soft ware is the real reason for Armstrong's imprisonment on an unprecedented civil contempt charge for which he had been imprisoned for over seven years. The fact that Armstrong was imprisoned without a conviction on the charges lodged against and subsequently serve the longest term for contempt in U.S. history certainly lends credence to evidence of a government conspiracy against him. The contempt charge was vacated in 2007 and Armstrong was sentenced still without a trial by jury on the pending charges, to an additional five years. Ironically, this term will possibly see him released at the critical juncture of another one of his predictions, the bottom of the equity market on June 18, 2011. Regarded by many as a political prisoner, concerted efforts have been made for his release accompanied by his own legal petitions issued from the Fort Dix Federal Facility where he is confined.

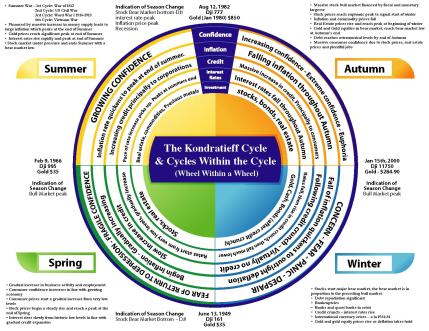

Nikolai Kondratieff suffered similar and yet much more dire consequences. His arrest in 1928 culminated a short lived career during which he first served as the ill-fated Kerensky government's "minister of supply". Lenin subsequently appointed Kondratieff as head and founder of the Institute of Conjuncture and mandated him to engage in an extensive study of the capitalist economic system to discover the timeline and mechanics of its eventual collapse.Instead,while traveling throughout the West including the United States, Kondratieff discovered the regular rhythmic cycles of expansion and contraction which came to be the hall mark of his wave theory. In this capacity he actively participated in the Soviet Five Year Plan during the following years where his emphasis on the "primacy of agriculture and the industrial production of consumer goods "ran afoul of Stalin's purge of the kulak farmers, the disastrous collectivization, and the subsequent decimation of agricultural production in favor of the push for massive industrialization and "modernization"programs undertaken under the auspices and massive subsidization of Standard Oil and the Rockefeller and Ford foundations. After being kicked around the Stalinist gulags for the better part of a decade, Kondratieff was summarily executed after a peremptory trial in September of 1938 at the height of the Stalinist purges. In the midst and in spite of the political mayhem in which he was embroiled, Kodriatieff found time to develop and found his long wave theory publishing his "Long Waves in Economic Life" in 1926. True to his agricultural background, Kondratieff's long waves were equated with and expressed in their seasonal equivalents whereby he envisioned a similar cyclic nature of economic life. The following chart gives a fine graphic depiction of his stated theory. Important to understand are the cycles within cycles which typify both Armstrong and Gann as well as Needham in their subsequent attempts to discern and define the effective presence of similar waves or cycles in the economic life of nations and more specifically in the indices of financial markets and currencies. Notice that the outer circle denotes confidence or lack thereof a major indicator of the tenor of each economic cycle, one of the major themes addressed by Armstrong in his numerous prison essays. These can be accessed most readily at scribd.com.. A fine archive can be found as well at Nathans Economic Edge

Meta-economics

Such a sweeping assumption, which dismisses a vast body of apparent evidence to the contrary, implies that the market itself is the only and absolute gauge of economic affairs, which themselves are subject to inscrutable cyclic laws. Needham, like so many others before, him lays claim to an understanding of these recondite patterns. The success of the predictive art pertaining to an empirical assessment of this underlying template validates the authenticity of what would otherwise comprise only a conditional value. Thus the more consistently successful that trading becomes the more it approaches the measure of absolute understanding inherent in the system. This becomes possible only in the marginalization of all irrelevant subjective variables possessing only relative significance, thereby having as its ultimate objective the elimination of the need or even the possibility of human interference.

Such reasoning suffers some obvious flaws which it shares with the assumed supremacy and triumphalism which is so characteristic of the prevailing paradigm of scientific determinism as well as the utopian social and economic constructs which are its inevitable and unfortunate concomitants. Economics, as much as it might be satisfying to assume so, is not a rigid and deterministic machine, whose variables one can manipulate like so many levers, pulleys, shafts and wheels, much less one which operates with no human agency as one stands by and busily records its workings. This is not to say that efforts based on such mistaken assumptions are not undertaken and often with an unbridled enthusiasm which increases in proportion to the disastrous consequences.This misconception is largely responsible for the breakdown of our economic "order". Disorder and chaos in human affairs and significantly in the all important sphere of economic relations result from flawed and faulty premises, which in turn derive from a seemingly limitless capacity for error deeply embedded in human nature, not the blind obedience to immutable and super-ordinary laws imbedded in time.

Does it matter to what degree of foreknowledge and design the policies implemented in the political and economic management of our social order are undertaken if they are based on an ill informed, misplaced, conception and faulty principles? In this respect the vaunted and seemingly transcendent cycles of economic activity partake only of the expectations of human aspiration and inventiveness which create them and their inevitable downfall and defeat is assured not so much by the blind forces of nature but by the inherent capacity for self delusion and deception, the lasting and tragic inheritance of our species.

Thus even the elites of the supposed oligarchical hierarchy which seem to exert such omniscient and plenipotentiary control over the political and economic structures of society possess severe and distinct limitations and perhaps even more so because they are possessed of an inherent moral blindness, a necessary concomitant of their unswerving devotion to the attainment of power and control over the destinies of nations and peoples. Such alleged conspiratorial cabals which apparently wield such awesome and unmistakeable powers, ultimately become the very agents which bring about the manifestations of the supposedly immutable cyclic influences in the economic and political spheres and most often not according to their own inscrutable reckoning and sometimes in a manner that contradicts their avowed intentions.

The chart above is a simplification of Kondratieff wave cycle which the authors (Redburn Partners) have adduced to represent what they perceive as a radical intervention by the Chairman of the Federal Reserve, Alan Greenspan, to stave off, as they see it, the deflationary collapse and recession of the natural cyclic descent into the Winter phase of the K wave economic cycle. Greenspan's intervention was accomplished by an aggressive loose monetary policy effected by sharp credit cuts down to 1% from May 2000 to June 2003 accompanied by massive injections of liquidity. This policy was supplemented by the "recycling of vast US deficits by creditor nations through the US Bond markets." The resulting globalization of capital markets resulted in the exportation of US inflationary policy to international markets and laid the groundwork for the worldwide economic meltdown we are presently witnessing as Greenspan's successor, Mr. B.S. Bernanke, expands and amplifies his predecessor's policies.

The chart above is a simplification of Kondratieff wave cycle which the authors (Redburn Partners) have adduced to represent what they perceive as a radical intervention by the Chairman of the Federal Reserve, Alan Greenspan, to stave off, as they see it, the deflationary collapse and recession of the natural cyclic descent into the Winter phase of the K wave economic cycle. Greenspan's intervention was accomplished by an aggressive loose monetary policy effected by sharp credit cuts down to 1% from May 2000 to June 2003 accompanied by massive injections of liquidity. This policy was supplemented by the "recycling of vast US deficits by creditor nations through the US Bond markets." The resulting globalization of capital markets resulted in the exportation of US inflationary policy to international markets and laid the groundwork for the worldwide economic meltdown we are presently witnessing as Greenspan's successor, Mr. B.S. Bernanke, expands and amplifies his predecessor's policies.

As it has been made abundantly clear by many economists and commentators, any attempt to manipulate or forestall the natural economic cycles can and will have disastrous consequences, the results of which are becoming clearer with each further evolution of the economic crisis.

There is no means of avoiding the final collapse of a boom brought on by credit expansion. The only alternative is whether the crisis should come sooner...or later as a final and total catastrophe of the currency system involved-Ludwig von Mises

Even a cursory study of the K wave cycles reveal that economic life is subject to the same natural forces which are constantly seeking the state of equilibrium essential to the sustenance and continuation of organic forms. The inflation/debt cycles partake of this natural law, the violation of which creates the sever distortions that are presently taking place in both ecological and economic systems. Just as the excesses and imbalances in any physical system left untreated tend to create disturbance and disease, the artificial and toxic workings of fiat monetary policy only prolong the state of financial imbalance against the natural and effective purgation of recession creating an immense hangover of toxic residues which require an ever more violent and cathartic abreaction. The K wave cycle beginning in 1948 has thus been attenuated by manipulation from its average 54 year cycle to 59 years, with the result that the catastrophic destruction of the currency system referred to by von Mises is upon us. The question becomes then not whether such obvious exogenous technical manipulations have been accomplished by design but by what agency and to what purpose such design is actually intended.

We witness the same in the disruption and manipulation of the cyclic processes of nature itself through industrial pollution and the liberal use of toxic chemical fertilizers and the recent introduction of genetically modified seeds. The attempts at weather modification, tomographic x-ray and interference in the ionosphere and earth's magnetic fields by the HAARP and Russian"woodpecker" scalar weaponization and aerosol dispersal of barium salts in so-called chemtrails are already revealing dire consequences across the planet. The discoveries of quantum wave theory alluded to above are operative in unprecedented scientific discoveries resulting in some of these very questionable and even destructive technologies operating across a wide spectrum of mostly black budget military programs related to so called defense related capabilities.

End Game-Needham Contra Gold

Ultimately, the fortunes and follies of "the trade", like so many other spheres of human activity which have profound influence on human affairs, are of little or no interest to the ordinary individual. The intricacies of finance and economics, just like the complexities and guiding principles of empirical science, which form the foundation and upon it the technological superstructure of the growing global order, remain a remote and inaccessible realm, the province of an elite and select group. The initiation into this empyrean depends much on birth and circumstance, though obviously education plays an important though more limited role. It often depends more on who one knows than what one knows when it comes to suitability for advancement into the influential circles from which emanate the power that controls and binds.

Gann, Gorn Old, and most probably Needham, are certainly representative of this clique which presupposes a certain established pedigree and philosophical attunement oriented towards the belief in the innate supremacy of a select group of individuals possessed of a superior and "hidden" knowledge. And most probably and to a large degree by his own admission, Needham's danielcode, much like Gann's system, is founded upon the arcane numerological, astrological, geomantic and "sacred" geometric correspondences peculiar to this system of knowledge. Needham's claim that "the greatest gift you can give yourself is to learn to trade the financial markets" is expressive of his almost worshipful view of the market and befits an attitude, which despite his professed neutrality regarding market commodities and forex currencies, betrays a singular antipathy if not outright aversion to gold and silver. His particularly vociferous stance on this subject earned him a sobriquet of which he is apparently quite proud, having recently been crowned GATA's "moron of the year". He earned this honor voicing such unequivocal comments such as the following.

• all the hyperventilating from the Gold bulls will sucker in a few small players. Perhaps more than a few have already been suckered but ultimately the weight of money always wins. The weight of money will determine the outcome.

• (referring to Gold being a haven and true store of value)...while those beliefs were true for centuries, modern machinations of paper shuffling carry trades and global markets have conspired to turn Gold and Silver into mere commodities

• the gold bull market is sold on froth on bullion from the carry trade not from consumer or investment demand.

While these comments may have once born a certain basis in fact they have been generally repudiated by some recent events. That is unless you consider China and India as well as major Central Banks small players and sources of insignificant investment demand. Whatever the case they place Needham squarely on the side of the gold bear camp and not surprisingly a committed apologist for the status quo, a view which is confirmed by his adamant support of Federal fiscal policies as below:

The present home mortgage drama sees federal and state officials from the president down trying to stabilize home prices with a plan to freeze mortgage repayments and offering Federal funding from Federal and State institutions to stop the mortgage resets that threaten to engulf the US home market. Both the intention and effect of these initiatives is to manipulate the property market by easing price pressures that a tsunami of foreclosures would bring.

This decidedly sanguine and naive view of a benevolent government engaging in economic policies with the aim of benefitting its populace is either an exercise in outright mendacity or self deception. Of course Needham is all for government manipulation of economic markets as he suggests that "it is part of their charter to manipulate markets. It is called price stability". These are but the expedient and superficial utterances of a day trader endlessly booking profit and occasional losses and are reflective of that peculiar moral blindness alluded to above. But then again this is an individual who penned an article entitled "Obama, the Dawn of Reason", an obsequious paean to the puppet of Goldman and Soros. All the while Needham proclaims that the Gold and Silver markets are"rational, precise, organized and reasonably predictable", that is only if you subscribe to the danielecode and its decidedly oracular and yet otherwise limited significations.

1 comment:

A couple links discussing Gann, Needham and Armstrong ... for your perusal.

http://anonymousmonetarist.blogspot.com/2010/02/ill-play-you-little-tune-on-my-violin.html

http://anonymousmonetarist.blogspot.com/2010/02/time-pundits.html

Post a Comment